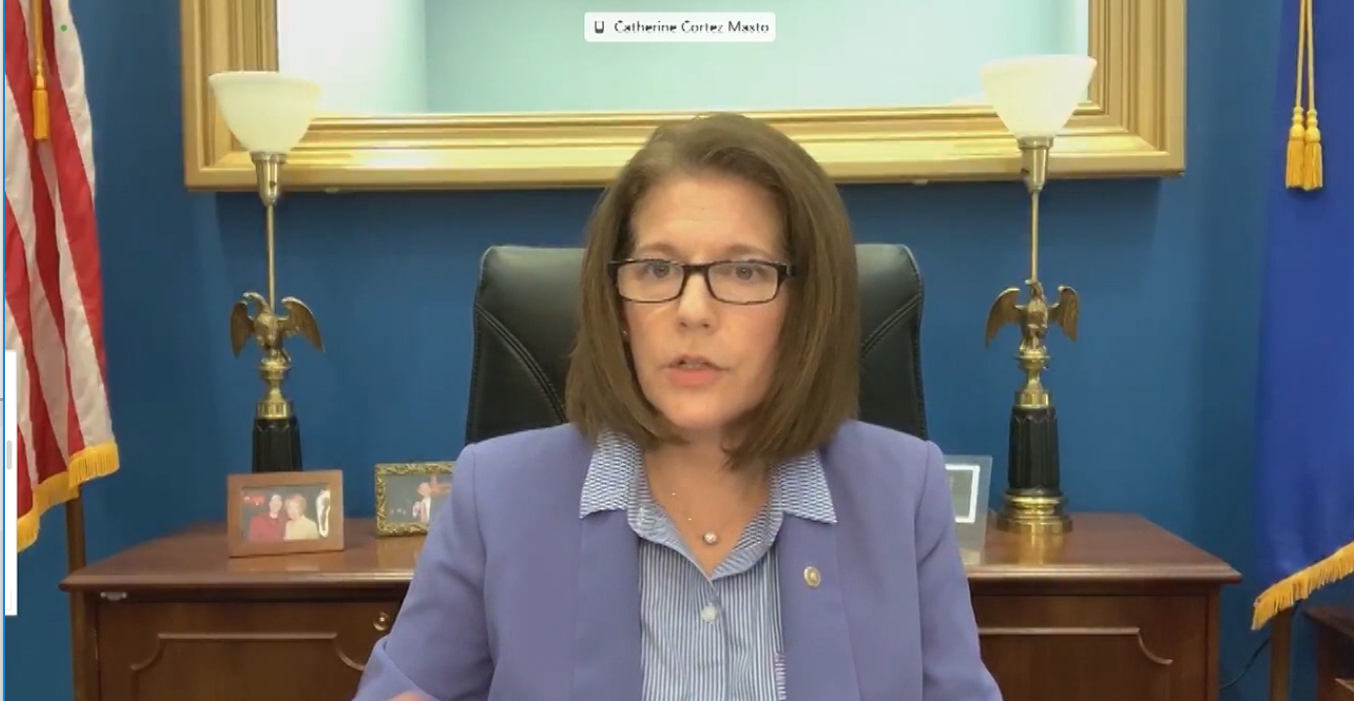

Washington, D.C. – During today’s Banking Committee hearing, U.S. Senator Catherine Cortez Masto (D-Nev.) questioned Director Kathleen Kraninger of the Consumer Financial Protection Bureau (CFPB) about predatory lending practices.

Senator Cortez Masto noted, “I’ve noticed a number of these cases resulted in suspended judgments. Meaning that—and particularly as I look at the debt collection companies, along with auto title companies and travel companies—they paid much smaller fines than was agreed to in the original judgment. Let me give you an example. In Florida, a debt collection company was charg[ing] illegal fees to 7,300 customers—7,300 customers. And to resolve the case, which went to court, the company was ordered to pay a $3.8 million dollar judgment. However, the Bureau suspended that nearly $4 million judgment and required the company to pay only $5,000, and the two business owners to pay only $7,000 and $10,000 respectively. So my question to you is, why was 99 percent of the fine suspended if the Bureau found that customers—7,300 of them—were illegally overcharged $4 million. But those responsible only paid $22,000.”

Director Kraninger responded that the CFPB takes into account the ability of the entity to pay the judgment in determining whether to suspend a judgment.

Senator Cortez Masto also inquired about how defrauded consumers could receive restitution when the Bureau determines that the company cannot pay. The Director replied that the CFPB’s Civil Monetary Penalty Fund ensures that funds are available for harmed consumers. The Senator has long fought to ensure that consumers who are victims of unfair, deceptive, and abusive practices receive compensation, both to offset the harm done to them and to prevent future companies from engaging in similar fraud.

Since the beginning of the coronavirus pandemic, complaints to the CFPB have increased 50 percent over the 2019 levels, including thousands of complaints about credit reporting, debt collection, credit cards and prepaid cards, and mortgages. Senator Cortez Masto encourages Nevadans with a financial services problem they cannot solve on their own to file a complaint to start the process.

Video of the full exchange is available here.

###